A personal name will have a fee of RM30 per year. However its important to understand how your business structure affects your taxes.

Registering An Enterprise In Malaysia Enterprise Success Business Consulting Business

The tax rate for sole proprietorship or partnership will follow the tax rate of an individual.

. Principles of Naming a Business. If youd like to know more about this process you can visit this SSM page to find out more. And out of all the legal structures this has the lowest annual fee as well.

Sole proprietors file fewer tax forms and spend less in startup costs than other types of enterprises. Depending on the range of your chargeable income the tax rate may. Do note however that you must be either a Malaysian citizen or a permanent resident to apply for a sole proprietorship in Malaysia.

Instead the profit made will come under the regular income tax the owner pays. This guide explains how to prepare file. Second there is Schedule C which contains information on the companys profit and loss.

Sole proprietorship need to pay RM30 personal name or RM60 trade name per year to renew the business registration. The business can be registered or renewed for a period of 1 to 5 years and not exceeding 5 years with the specified prescribed fee. The businesss name The principal location of the business.

The yearly price for registering under ones own name is RM 30 while the charge for registering under ones company name is RM60. The cost evaluation is marginal and way lower when compared with other form of business in this nation. A single owner is regarded as the same legal entity as the business in which they engage in their activities.

You dont have to pay taxes in Malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside Malaysia. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Do note however that you must be either a Malaysian citizen or a permanent resident to apply for a sole proprietorship in Malaysia.

RM 6000 a year. To do this you will need to register your new business at a local SSM branch. If youd like to know more about this process you can visit this SSM page to find out more.

Business is owned by two 2 or more persons but not exceeding 20 persons. Sole proprietorship Malaysia comes with enticing policies where the owner of the company doesnt need to corporate tax. A personal name will have a fee of RM30 per year.

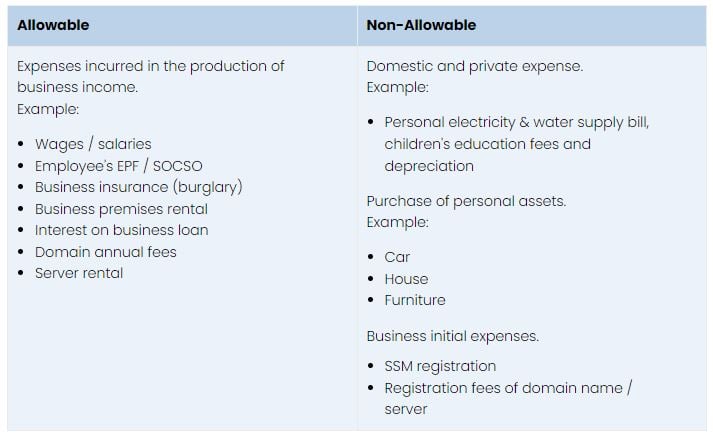

It will be applied to your chargeable income which is obtained after deducting all your business losses allowable expenses approved donations and individual tax reliefs. You can either do it in person or online at the Companies Commission of Malaysia SSM. The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia.

The registration process of registering your sole proprietorship in Malaysia should not take more than 30 days to complete. You then need to name your sole proprietorship either as your personal name or a business under which you trade. Sole proprietors are required to complete two forms in order to pay their federal income tax for the year in question.

Tax obligations also arise for these self-employed individuals who derive income from the country and spend more than a certain amount of days in Malaysia during each tax year. A sole proprietorship is the simplest and most popular type of business to establish. It is essential to fill out Form A which includes the following details.

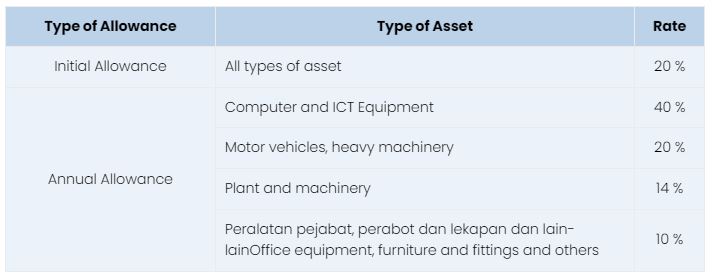

How much does it cost to register a sole proprietorship in Malaysia. Tax Rate for Sole Proprietorship and Partnership The tax rate for Sole Proprietor and Partnership varies based on scale rate ranging from 0 to 30. No corporate tax imposed- As the sole proprietorship is not a separate legal entity from the owner it will not get taxed as such.

Annual auditing is less complex and doesnt require separate company secretary. 7 How much is the yearly maintenance fee of a sole proprietorship in Malaysia. Low cost- registration costs are minimal.

When you have completed Form A and the permission name for it you should submit both forms to the SSM corporate headquarters. Personal Tax Relief 2021 L Co Accountants Within All Malaysia Government Websites. Theres the Form 1040 which is the individual income tax return which is the first step.

Additional RM500 a year for each branch registered and RM1000 excluding SST for business information print-out. One of the experts at our law firm in Malaysia can give you specific details about taxation for sole proprietors and information about the double tax treaties and how or if they apply if you are a. There are tax laws that sole proprietors need to know.

Consequently some may consider closing their Sole-Proprietorship or Partnership. Apart from this the following requirements must be met in. Being a sole proprietor or independent contractor can simplify your finances.

Wholesale Retail Trade Wrt License In Malaysia

Company Secretary Bangladesh Company Registration Process In Usa Company Secretary Consulting Firms Kong Company

How Do You Register A Sole Proprietorship In Malaysia

Understanding Business Entities In Malaysia Quadrant Biz Solutions

Follow These Important Steps To Register A Company In Malaysia

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Accounting Malaysia Importance Of Financial Statement By Beyondcorp

Meaning Of Accounting Services

Legal Steps For Company Incorporation In India Corpbiz

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

How To File Income Tax For Your Side Business

Labuan Offshore Company In Malaysia

Types Of Visa In Malaysia Malaysia Small Business Ideas Visa

How To File Income Tax For Your Side Business

Third Party Accounting Services In Singapore Makes You Completely Tension Free Accounting Services Accounting Bookkeeping Services